The greatest growing hunting demographic in the country is women. This has piqued the interest of journalists, at least one social scientist, game and fish departments around the country and of course, the outdoor recreation companies. As with most trends, people want to know why.

Recent articles by National Geographic, The Globe and Mail and the Dallas Daily News report anecdotal stories about women who are getting into hunting and their reasons for doing so. Most cite a desire to know where their meat comes from and a strong pull to spend time outside. Over the years I have taught five women how to shoot in preparation for their first hunting season and gathering their own meat was the reason they wanted to start.

Earlier this year, I noticed the headline in the Missoulian (reprinted from the Spokesman-Review) “Relationships a motivator for more women entering hunting.”

I cringed. The article referenced a project by Stacy Keogh, Ph.D., a professor from Whitworth University in Spokane, who interviewed forty women who hunt.

“It appears, then, that women approach hunting not strictly from a recreational angle, but one that considers relationships as a primary motivator to participation,” Keogh said.

My first thought was, great, so do men, what’s the story here? Second thought was, great, just want we need is people only reading the headline (which is very common) and thinking women are going hunting to like, hang out with our boyfriends and stuff.

Arch Coal lost nearly 90% of its stock price on the New York Stock Exchange (NYSE) in the first eight months of this year.

In a last ditch effort to prevent their stock from being delisted from the NYSE, on August 4, 2015, Arch Coal initiated a one-for-ten reverse stock split to increase the market price per share of their common stock. Delisting procedures are initiated when a stock price trades under $1.00/share for over 30 consecutive trading days. To stay listed with the NYSE, a company is required to maintain certain standards in order to assure investors that any company listed is a credible company.

After the reverse stock split Arch Coal’s shares opened at $1.61. However, the financial maneuver didn’t work. This morning, a mere 10 days after the paperwork was finalized, their stock opened at $1.16/share, losing 28% its value since the split. Most analysts see this as a indication that Arch Coal is heading for bankruptcy, joining Alpha Natural Resources.

On July 27, 2015 the Northern Cheyenne Tribe renewed their request for a 120-day comment period on the draft environmental impact statement (DEIS) for the proposed Tongue River Railroad. This time the request was accompanied by a letter of support from Governor Bullock’s office. A previous request from the Tribe for a 120-day comment period, supported by Senator Jon Tester and State Auditor Monica Lindeen, was initially denied by the Surface Transportation Board.

This morning we received a notice from the STB that they are extending the comment period until September 23, 2015, 30 days shorter than the Tribe and the Governor requested. The STB also indicated that no further extensions will be granted.

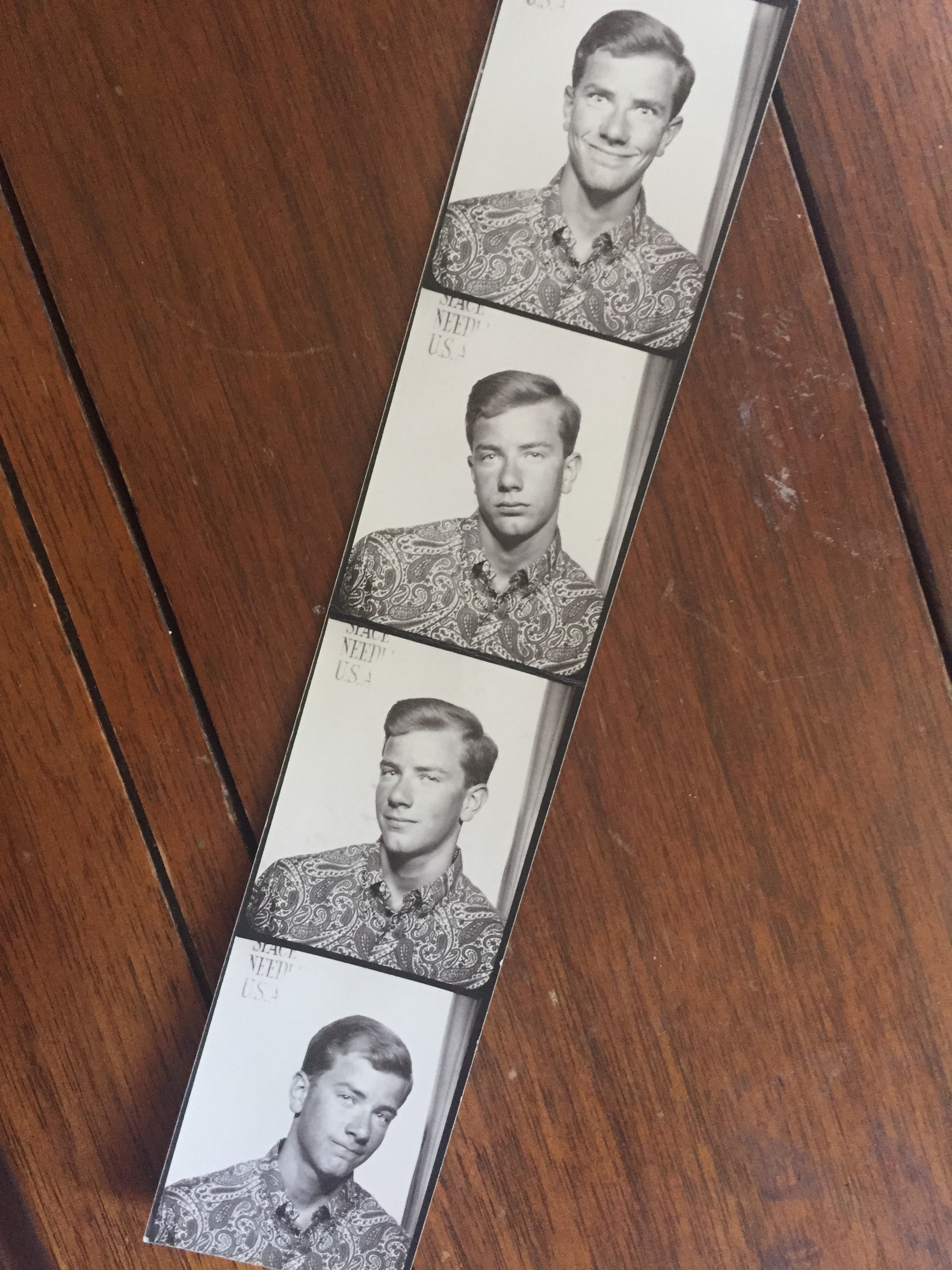

I walked in to my dad’s garage last weekend and hit the power button on his stereo. The Doors sang Break on Through and the volume was all the way up. I stood at his workbench and listened until Jim Morrison finished the last chorus. I closed my eyes and for a moment I pretended he was outside fixing a broken down piece of equipment. When he worked on our farm he turned on the stereo in the garage as loud as it would go, opened all the doors in the shop and then wandered around listening to something else in his AM/FM stereo headset, singing along poorly with no regard for the correct lyrics.

Everything in his garage is still mostly where he left it. On his workbench sits a dusty old wagon night-light he was always meaning to fix for me when I was little. There is also his antique watch repair toolkit, the tennis balls he would take the felt off of so it wouldn’t wear the dog’s teeth down when they played fetch, his meticulously organized tool drawers with handwritten labels, his bike tire pump that he had since he was a child, pocket knives, Strike Anywhere matches and an old tin of Prince Albert.

He was so particular about his stuff. This is a trait I did not inherit. I have his long toes, the Bonogofsky nose and his stubbornness but not his need to keep things in order. I borrowed fencing pliers. He found them on the back of the four-wheeler and a 20-minute lecture followed. Did I change my behavior? Nope. Instead, for example, one time I bought a new pitchfork and left it down stuck in the goat’s round hay bale. He took it out and put it in the shed, “where the pitchforks go.” It was a constant battle between us. I bought it, I could ruin it if I want to, I told him. Now that he is gone, I use his tools and put them back exactly where he kept them.

On June 15, 2015 at the U.S. Energy Information Administration’s annual conference in Washington, Matthew K. Rose, Burlington Northern Santa Fe’s (BNSF) executive chairman, said the following concerning infrastructure investments that BNSF made in the Powder River Basin (PRB).

“Less than 10 years later, I don’t anticipate that we’ll see that level of coal volume again. That leaves us with millions of dollars in investment in what will eventually be stranded assets.”

Rose also stated that PRB coal accounts for about 20% of BNSF’s traffic, down from 25%. He said this is “the fastest-changing story in railroading.” In other words, the head of BNSF doesn’t see any expansion in coal production in the PRB. In fact, he sees it continuing to decline.

The question is why does BNSF continue to push for the Tongue River Railroad in the northern PRB? A railroad that is projected to cost, at minimum, around half a billion dollars to construct. The railroad infrastructure that Rose is referring to as “stranded assets” serve mines that are already in operation and are producing millions of tons of coal per year. Why invest more money to serve a coal mine (Otter Creek mine) that still doesn’t have a permit and has low BTU coal, coal that is not competitive on the export market, according to the STB.

BNSF has everything going against them in relation to the Tongue River Railroad: extremely high community opposition, sinking demand for coal both domestically and abroad, low coal prices and declining rail traffic out of the PRB’s existing mines. Oh yeah, and they also have a partner that is bordering on bankruptcy. Arch Coal’s stock closed at 33 cents/share today. They also have a heavy debt load and around 418 million dollars in current coal mine reclamation liabilities as of December 31, 2014.

The people in southeast Montana are fully aware that a game is being played by companies and individuals who see the Otter Creek and Tongue River Valleys as just a dot on a map with resources to sell. Wouldn’t it be nice if BNSF acted on what they already know and what they already stated publicly: investing any more money in coal from the Powder River Basin, especially in a greenfield mine and a new rail line, is a losing proposition.