New timeline for the Otter Creek coal mine EIS

I woke up this morning to a phone call from a friend in southeastern Montana.

“Did you read the Billings Gazette this morning?”

“Not yet, why?”

“Arch Coal just lost their ass.”

What he was referring to was today’s headline in the Billings Gazette, Arch Coal writes DKRW Advanced Fuels’ coal gasification project as a $57.7 million loss.

The coal to liquids project they proposed in Medicine Bow, Wyoming was a speculative venture (at best) that would have bilked taxpayers out of billions of dollars in public loan guarantees. Arch Coal invested $25 million dollars in 2006 for a 24% stake in the company. Taxpayers for Common Sense (TCS) found that there was no real high point for the project backers. DKRW started losing money the same year that Arch Coal began investing in the project. TCS found they lost $400,000 in 2006, $6.7 million in 2007 and $17.5 million in 2012. Arch Coal loaned DKRW a total of $44 million between 2006 and 2013, none of which has been recovered.

How this relates to the proposed Otter Creek coal mine and Tongue River Railroad

Arch Coal is a company in dire straits. When they leased the Otter Creek coal tracts in 2010 their stock prices hovered around $35/share. Today it’s at $4.47/share. Yesterday, they posted a bigger than expected quarterly loss due to lower coal prices and weak demand.

If you are under the impression that this is a company capable of opening a new greenfield mine and building a new 43-mile rail line to haul their coal, you’re wrong. If you think that this is a company who has the resources to successfully reclaim the Otter Creek valley back to anything even close to the original condition, you’re wrong.

So the real question we should be asking is what is Arch Coal’s plan for the Otter Creek and Tongue River Valleys?

Arch Coal is trying to secure the necessary permits from the state of Montana in order to sell the permitted but unbuilt mine to another company. Coal tracts with a permit are a lot more valuable than coal tracts without a permit.

They spent a combined $159 million dollars to lease the coal tracts in the Otter Creek valley from the state of Montana and Great Northern Properties. $159 million is a bit harder to walk away from than $57 million.

The ever-changing Otter Creek coal mine timeline

The hole Arch Coal isn’t digging just keeps getting bigger and bigger.

Not only does Arch Coal not have enough money to open a new mine, they are also faced with the stipulations of the lease which gives them a 10-year window to develop the mine. It has been almost exactly four years since they leased the coal from the state of Montana.

They still do not have a permit.

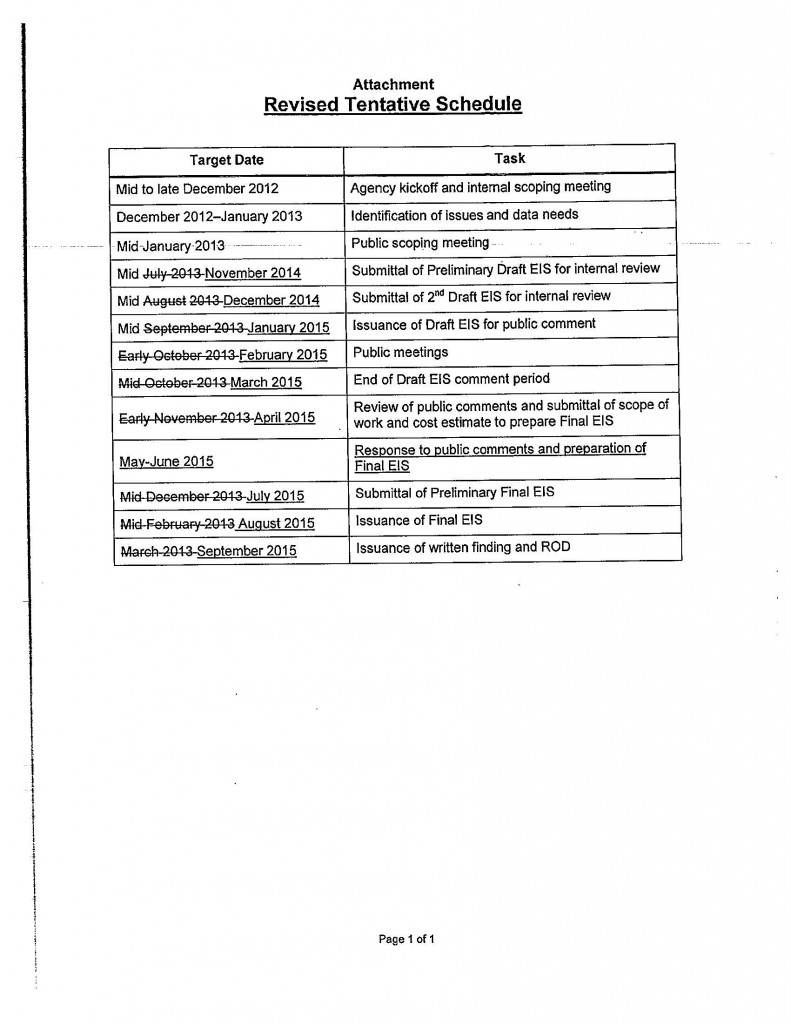

Just a couple days ago, Mike Rowlands, Arch Coal’s only employee in Montana, signed a new agreement with Montana Department of Environmental Quality extending, yet again, the timeline for the Draft Environmental Impact Statement. The new release date has been pushed back to January 2015 instead of September of 2014. The new Record of Decision and Final Environmental Impact Statement is now not expected until September of 2015. Unfortunately, the new expected dates for public hearings are in February of 2015 which, as you know, is not the easiest time to be traveling in southeastern Montana. But, at least it’s not during hunting season!

Stay tuned though. I’m pretty sure by fall of 2014, I’ll be writing another piece about yet another change in the Otter Creek timeline.

Arch Coal and DEQ new timeline

Any coal company with a stock price of $4.35, should NOT be allowed to self-bond. They left a mess at the Rosebud mine north of Hanna, Wyoming. There needs to be a massive outcry from those in the Tongue River basin to Montana DEQ forcing Arch to post bond to obtain their mine permit. No self bonding should be allowed! This requirement would stick a fork in the Otter Creek project. Let’s make this happen.

Pingback: Montana in Review – April 14 – 27, 2014 | Mountains, Plains & People

Pingback: Another Delay For The Tongue River Railroad | east of billings